What is MemberCheck¶

MemberCheck is an AML/CTF compliance service designed to enable you to check your client, customer or member (“member”) records against global sanctions and politically exposed person lists, in an efficient and cost effective manner, obtaining immediate and up-to-date feedback on the potential exposure of members to AML/CTF activities.

The service has been developed to assist reporting entities in meeting their obligations under the AML/CTF Act 2006 (Australia) and the AML/CFT Act 2009 (New Zealand), in an efficient and cost effective manner.

MemberCheck partners with Acuris Risk Intelligence, who provide one of the world's largest databases, known as the C6 Intelligence Database, to help businesses manage their risk and compliance in real time. The C6 Intelligence Database provides an extensive global coverage of senior Politically Exposed Persons (PEP), their relatives, close associates and the companies they are linked to; national and international government sanction lists; regulatory and law enforcement lists; other official lists and persons officially linked to, or convicted of, high profile crimes or terrorism.

With specialist researchers fluent in over 40 languages across 3 continents, the C6 Intelligence Database accesses 14 years of adverse media to the widest fraud and cybersecurity datasets available. With Latin and non-Latin scripts available, MemberCheck provides the ability for you to scan against names in their original script, such as Arabic, Chinese, Cyrillic, Korean, Japanese, Thai and other non-Latin/Roman scripts.

To ensure your scans are accurate and up-to-date, MemberCheck updates the following C6 Intelligence Database profiles daily.

-

PEPs, their Relatives and Close Associates

Detailed information of over 1.4 million profiles consisting of senior PEPs, their relatives and close associates and companies they are linked to, from every country in the world.

-

Sanctions and Official Lists

Sanctions, regulatory enforcement, law enforcement and other official list profiles, including those issued by the UN and major government departments, worldwide.

-

Persons and Entities of Special Interest

Over 1.2 million high profile people and entities not on an official list but reported in publicly available sources as being accused of, or convicted of serious crimes, including financial crime, organised crime, terrorism, narcotics crime and other crimes or blacklisted by an acknowledged international or regional finance body (e.g. World Bank and other regional development banks).

Platform¶

MemberCheck is a secure and comprehensive web-based solution, which is pre-configured with Acuris Risk Intelligence data for receiving PEP and sanctioned entities watchlists. The solution offers a multi-organisation scanning, administration and reporting interface and offers the following key features to assist your organisation in meeting its AML/CFT obligations:

-

Support for multiple organisations and organisational hierarchies

-

Access to administration, scanning and reporting functions using pre-defined user roles with fine grained access control

-

Daily update of compliance lists of politically exposed persons (PEPs), sanctioned individuals and entities and persons of special interest to ensure accurate, reliable, complete, and up-to-date information to scan against

-

Ability to customise the watchlists to be utilised for scanning

-

Daily and periodic batch scanning to check batches of new members, clients or account holders, or an organisation’s entire member or client base

-

Real-time, ad hoc single scanning to check individual members or clients when they join, open a new account or require payment

-

Single and batch corporate scanning to check corporate clients

-

Match settings that can be customised at organisation or scan level e.g. Match Type, Whitelist, Country of Residence and PEP's Country of Jurisdiction

-

Ability to view full profile details of scan match results

-

Due diligence workflow, which enables due diligence decisions and reasons for the decision together with a risk assessment for ‘true match’ and ‘not sure’ decisions to be recorded and stored against each match

-

Whitelist creation, based on previous due diligence decisions, to eliminate future false positive matches

-

Comprehensive scan and match reports, results and category analysis

-

Match reports which can be exported for customisation and further investigation

-

Email notification of scans performed provided to the organisation’s Compliance Officer or a specified email address

-

Data maintenance of member and company batches

-

Full audit capabilities of scanning activity

Also available (please contact support@membercheck.com for further details)

-

A batch upload facility for auto-scanning batch files

-

An Application Programming Interface (API) that provides real time single scan interfacing with your organisation’s application, over HTTPS

Website¶

Once an organisation has enrolled with MemberCheck, a Compliance Officer’s username and password will be provided, which will enable access to the MemberCheck Client Site (membercheck.net and click the Sign In button).

The MemberCheck Client Site has the following Main Menu items, to which access is restricted by the use of user roles.

-

Member Scan - used to perform single and batch scans of member against selected watchlists, review scans performed previously and implement due diligence decisions on matched entities in order to build a Whitelist for future scans.

-

Corporate Scan - used to perform single and batch scans of corporate data against selected watchlists, review scans performed previously and implement due diligence decisions on matched corporate entities in order to build a Whitelist for future corporate scans.

-

Report - used for reporting on scanning activity by a selected Organisation, or group of Organisations, over a specified period and for reporting scan match results and due diligence decisions.

-

Administration - used for setting up and configuring organisations and users and managing batch file data. Also used for individual users to maintain personal details, and change password and security question.

-

Integration (for API users only) - provides access to API documentation and the MemberCheck API Developer Centre (MemberCheck's Application Programming Interface (API) provides real time single scan interfacing with an organisation’s application).

Browser Requirements¶

MemberCheck is best viewed using recent versions of Mozilla Firefox, Google Chrome or Microsoft Edge and Internet Explorer.

Microsoft Office 2007 or higher is required for viewing Reports exported in Excel or Word format.

Timeouts¶

If the MemberCheck site remains idle for a specified period of time you will be automatically logged out. The next time you access the site you will be requested to login again.

Scanning¶

MemberCheck scans records of individuals or companies, individually or in batch files, against Acuris Risk Intelligence data of Politically Exposed Persons (PEP), those associated with terror (TER), officially sanctioned individuals, persons of special interest (SIP) and entities of special interest (SIE), providing up-to-date feedback on their potential exposure to AML/CTF activities.

Due diligence decisions for scan matches can be recorded and a Whitelist created of individuals or companies, who have been determined to NOT BE a true match of the entity identified in the scan. Future scans can apply the Whitelist and eliminate scan matches previously identified to not be a true match.

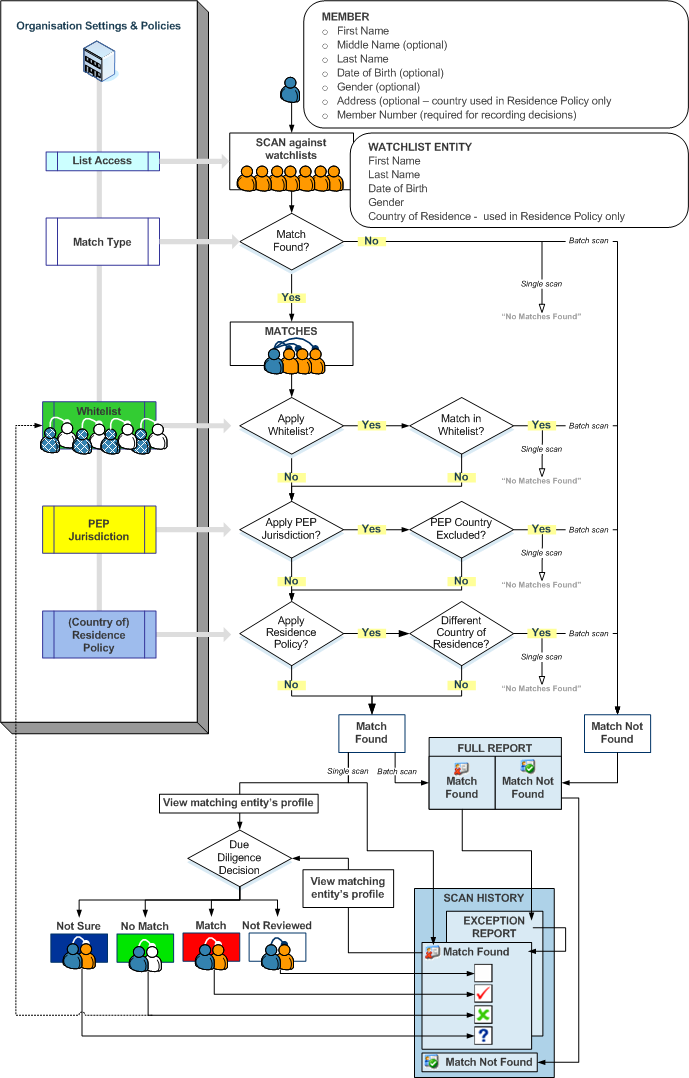

This diagram shows how the scan settings and policies are used to optimise the member scanning process and eliminate false matches.